What Does Rrr Stand for in Economics

What is the RRR Adjusted for Inflation?

The required rate of return (RRR) adjusted for inflation is the required rate of return after considering the effects of inflation. Recall that the required rate of return (also known as hurdle rate Hurdle Rate Definition A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved, current opportunities in business expansion, rates of return for similar investments, and other factors ) is the minimum return that an investor is willing to accept for an investment.

What is the Required Rate of Return?

The required rate of return is one of the most fundamental concepts in investing that is used as the benchmark to determine the feasibility of an investment project. If the return of an investment is less than the required rate of return, the investment project must be rejected.

Conversely, if a return of an investment exceeds its required rate of return, the project must be undertaken. At the same time, a lesser required rate of return indicates a lower level of risk attributable to the investment while a higher RRR is associated with the higher underlying risk of a project.

Despite the importance of the required rate of return, the financial measure still comes with a number of flaws. For example, the RRR does not account for several macroeconomic factors such as inflation, which is a sustained price increase of goods and services in the economy. Essentially, the sustained increases in prices result in the erosion of the value of money. Thus, the nominal required rate of return without considering the effects of inflation deliver potentially misleading conclusions on the viability of an investment project.

The RRR adjusted for inflation is especially useful in comparing investment projects occurring in different countries. The main reason behind the fact is that counties around the world face substantially different inflation rates. For example, think about a company that considers two investment projects: one located in the United States and the other in Turkey.

Although the nominal RRR for the project in Turkey is higher than the nominal RRR for the project in the United States, we must admit that the inflation rate in Turkey is almost ten times higher than in the United States (20% vs. 2%, respectively). Thus, if we adjust the nominal returns of the projects for the inflation effects, we will discover that the real required rate of return of the project in Turkey is far less than the real required rate of return in the United States.

Formula for the RRR Adjusted for Inflation

Essentially, one can easily calculate the required rate of return by knowing the corresponding nominal RRR. The mathematical formula for adjusting the required rate of return for the effects of inflation is:

Where:

- RRR – the nominal required rate of return of an investment (does not consider the effect of inflation)

- i – the inflation rate

Example of the RRR Adjusted for Inflation

Company A considers two investment projects occurring in two different countries. Project 1 is will be implemented in Country X while Project 2 will be executed in Country Y. As an analyst at Company A, you are tasked to prepare the calculations to determine which of the two investment projects is more feasible for your company.

The required rate of return (RRR) can be used as a measure to identify which of the investment projects is more attractive. You've discovered that the nominal required rate of return for Project 1 is 6% while Project 2's nominal required rate of return is 10%. However, you know that the nominal RRR does not consider the effects of inflation, but Country X and Company Y report different inflation rates of 2% and 7%, respectively). Thus, the nominal RRRs must be adjusted to obtain more trustworthy conclusions.

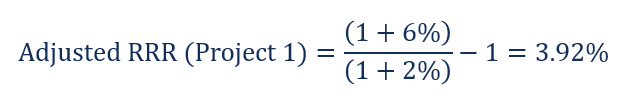

Using the information above, the RRRs adjusted for the inflation effects can be found in the following way:

The results above show us that Project 2 is less attractive than Project 1 from the investor's perspective since high inflation in Country Y destroys a large portion of the project's return.

Additional Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful:

- Accounting Rate of Return Template Accounting Rate of Return Template This accounting rate of return template will demonstrate two examples of ARR calculation. Accounting Rate of Return (ARR) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. The ARR is a formula used to make capital budgeting decisions. Thes

- Economic Indicators Economic Indicators An economic indicator is a metric used to assess, measure, and evaluate the overall state of health of the macroeconomy. Economic indicators

- Market Risk Premium Market Risk Premium The market risk premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets.

- Project Management Project Management Project management is designed to produce an end product that will make an impact on an organization. It is where knowledge, skills, experience, and

What Does Rrr Stand for in Economics

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/rrr-adjusted-for-inflation/

0 Response to "What Does Rrr Stand for in Economics"

Post a Comment